MBRS - XBRL Tagging Service

DataTracks provides XBRL preparation service to help you file XBRL through MBRS to SSM, during voluntary phase as well as in the future once XBRL is mandated to all businesses.

As an expert XBRL service provider, DataTracks has done projects with several Companies, Auditing and Secretarial firms in Malaysia in this voluntary period, to successfully convert financial statements to XBRL format to comply with SSM.

DataTracks invites large entities to participate in the SSM’s MBRS, XBRL pilot phase for testing and submission.

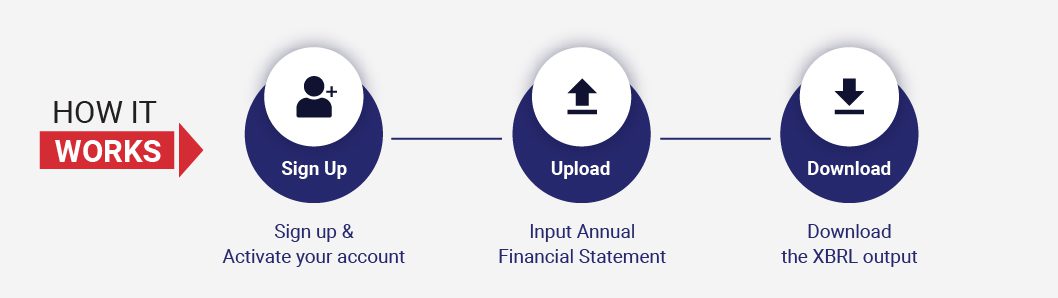

Register with us for XBRL conversion for MBRS submission with SSM

MBRS - XBRL Tagging Service

Solutions Beyond Compliance

It is an added burden for accountants to get fluent with Malaysia’s evolving taxonomy, let alone the new compliance requirements being issued every day in context to XBRL. And, even though XBRL filing is voluntary in Malaysia, most businesses are moving towards this new method of financial reporting, which makes it all the more challenging for accountants to serve their clients.

With so much already on the plate, accounting firms are also being imposed by the daunting task of complying with Suruhanjaya Syarikat Malaysia (SSM) MBRS, XBRL reporting format.

DataTracks to Your Assistance

Having prepared over 220,000 compliance reports across the globe, DataTracks has honed a vast experience in preparing XBRL reports. Rest assured, with the quality and error-free conversion services from DataTracks, accounting firms can free-up their time to focus on their core accounting activities.

Carrying an extensive experience of over 17+ years, DataTracks offers error-free XBRL conversion and reporting services, helping you meet your clients’ needs.

For XBRL service for MBRS filing, register with us , and we will get back to you.

Frequently Asked Questions

SSM MBRS is the Malaysian Business Reporting System mandated by the Companies Commission of Malaysia (SSM). It requires companies to submit Annual Returns and Financial Statements in a specific digital format called XBRL. Failing to comply can result in penalties and affect your business standing. DataTracks helps you easily meet these requirements, simplifying your XBRL filing process.

XBRL services include the conversion of financial statements in Word, Excel, or PDF, tags with corresponding data elements with respective regulatory taxonomies, and validation of the final XBRL output via the regulator’s validation tool. These services are crucial for ensuring accurate and timely compliance with various financial regulatory bodies, which include SSM for MBRS filing in Malaysia.

Companies often encounter various challenges during the XBRL conversion process for SSM MBRS filings, which include the accuracy of the XBRL output knowledge and XBRL expertise for correct tagging, the time-consuming process, etc. Partnering with experts in XBRL preparation, like DataTracks, can help organizations overcome these challenges and streamline their financial reporting processes.

Outsourcing XBRL compliance and financial statement preparation can save companies valuable time and resources. It allows them to concentrate on their core business activities, confident that their financial reporting meets regulatory standards. Choosing DataTracks as your outsourcing partner ensures not just compliance but a trusted ally committed to accuracy and efficiency in navigating the dynamic regulatory landscape.

Our MBRS XBRL preparation services streamlines the conversion of your financial documents into the SSM-compliant MBRS XBRL format. It comes with features designed to streamline the tagging process, reduce errors, and save time, making your SSM MBRS filing process more efficient and reliable.

Our service specializes in MBRS / XBRL preparation for SSM filing, offering a comprehensive solution that minimizes the complexities involved in regulatory submissions. By employing our service, you can ensure a hassle-free, accurate, and timely SSM MBRS filing.

Engaging in SSM MBRS XBRL filing offers numerous benefits. Firstly, it standardizes your financial reporting, making it easier for regulatory authorities like SSM to assess and verify the data. This also simplifies the data exchange process, reducing the room for error and saving you valuable time.

DataTracks Malaysia is your trusted choice for XBRL compliance. With 18 years of experience, our experts know the ins and outs of SSM taxonomy and the latest regulations. We’ve successfully assisted over 23,400 clients in 26 countries, delivering 348,000 reports. Choose us for a reliable partner committed to making your XBRL compliance smooth and accurate.

Schedule A Demo